Are we off to a Happy New Year America? Things affecting our business could be changing big time in 2017.

For the real estate sector there are many areas likely to be affected by the new administration. Residential and commercial construction, infrastructure projects, interest rates and legislation are all likely to see increased activity. Which will have the greatest impact remains to be seen.

For the real estate sector there are many areas likely to be affected by the new administration. Residential and commercial construction, infrastructure projects, interest rates and legislation are all likely to see increased activity. Which will have the greatest impact remains to be seen.

Residential construction will likely outpace commercial projects and eventually bring balance to many areas of the country. Currently there is a seller’s market in many MSAs with brisk sales reported in many parts of the US. According to the National Association of Homebuilders, there is only a 4.6 months supply. A balanced market is usually reflected by about a 6-month inventory.

Things look promising for increases in infrastructure projects, which will create jobs, not low wage – fast food jobs but more skilled labor jobs with higher paychecks. America’s roads, bridges, airports and tunnels need, in large part, a major facelift. Infrastructure projects appear to be a priority for the new administration.

The elephant in the living room for most people involved in the housing markets are those pesky interest rates. 10-20 loans dating back to 2006 that haven’t been refinanced are now beginning to reset and will likely put a lot of properties at risk. It might also create some excellent buying opportunities from sellers who will not be able to handle the significant increase in their monthly payments.

More importantly are the concerns that rising interest rates will dampen the robust seller’s market. Interest rates are very likely to rise because there is nowhere for them to fall as they remain at historical lows. With the growing reports of increased consumer confidence driving fears over inflation (which the Federal Reserve seeks to control with interest rate hikes) we’ve seen the first increase in an exceedingly long time. More will follow, but remember this, at $20 Trillion in government debt, interest rates cannot rise too fast or our federal government’s interest only payments would cause a further decline to our nation’s debt rating and increasing a risk of recession.

Last, but certainly not least we are likely to see legislative reform involving the Wall Street Reform Act, commonly known as Dodd-Frank. This legislation is not all bad but it has had negative consequences in the provision of liquidity for the residential housing market. Over-regulation and a lack of accountability of the Consumer Financial Protection Bureau has in some ways hamstrung banks.

Dodd-Frank has also impacted the ability of investors across America to provide seller financing to underserved sectors of the population in a manner that makes it beneficial for all parties involved. It remains to be seen what changes will occur but with the support of organizations such as National REIA and the National Association of Realtors there may be some relief in sight.

Dodd-Frank has also impacted the ability of investors across America to provide seller financing to underserved sectors of the population in a manner that makes it beneficial for all parties involved. It remains to be seen what changes will occur but with the support of organizations such as National REIA and the National Association of Realtors there may be some relief in sight.

Price growth I continuing on along the east and west coasts and major inland cities. The breadbasket and rust belt states are likely to see less price volatility while enjoying rent stability. Both types of areas create opportunity for the disciplined investor whose exit strategies are guided by their acquisition methodology.

OK, so what do we as investor’s do? Keep making offers; use good metrics on your real estate purchases, use positive leverage – don’t speculate and work within your sphere of influence. While it is possible, even probable, for rates to rise in 2017 they do not rise vertically. They rise gradually over time. A 50 to 100 basis point increase could happen between now and year-end but what does than mean to buyers in real dollars and cents? This is the key question not what the alarmist media broadcasts.

The payment on a $100,000 mortgage at 4% is $477.42 a month and at 4.5% it rises to $506.69 a month. That is less than a dollar a day or about 1.6 Starbucks a week and an increase to 5% increases the payment to $536.82. Yes, this can impact some families but if they are that tight on their monthly budget, they may be better off waiting to purchase a home. And yes, that would diminish demand somewhat but by how much?

Many of the families that would potentially fall into this category will be buoyed by the improving jobs market and higher wages. I don’t want to sound like a societal blasphemer but there are some families that do not and should not qualify for home ownership until they have a better financial position. In many cases they need education to help them understand how to become a successful homeowner.

They need the financial discipline required to manage a household budget and the responsibility that comes with home ownership. This is where rent to own and lease option programs can really serve families who want to achieve the American Dream, but aren’t fully ready, can benefit from working with investors. They can become homeowner’s in training; learn the ropes, save for a larger down payment and clean up bruised credit that will qualify them for lower interest rates.

All told, these are my personal opinions and you are welcome to agree or disagree but know this, 2017 will have plenty of opportunity for those willing and able to get out there and take effective action. Rentals will remain vibrant, as rents are likely to continue rising and fix and flip activity will serve those who buy right and deliver a quality product.

The clock it ticking so keep learning, keep growing and keep making offers! It isn’t construction, legislation or interest rates that will make 2017 a great year … it’s YOU! So play full out and take effective action everyday!

The clock it ticking so keep learning, keep growing and keep making offers! It isn’t construction, legislation or interest rates that will make 2017 a great year … it’s YOU! So play full out and take effective action everyday!

Augie Byllott is a full time real estate investor, trainer, speaker and coach. He is also the author of the Financial Freedom Formula now available on Amazon.com.

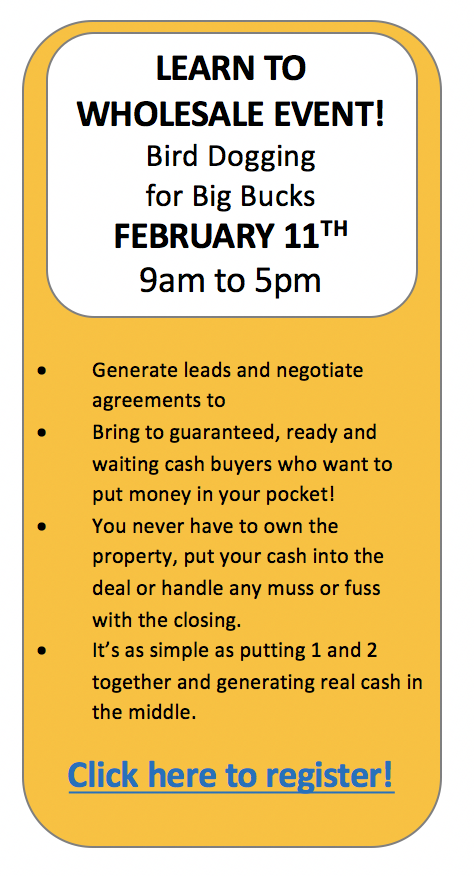

Check our upcoming events calendar here http://www.creatingwealthusa.com/